Bitcoins – how to find each other and how to find them?

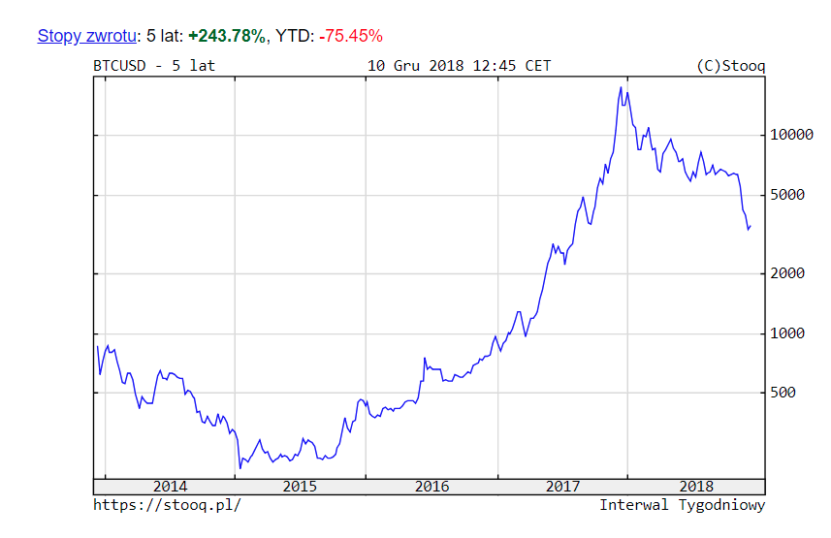

Last year, a lot was said about the revolution brought with him the cryptocurrency market. Until 2017, most people treated virtual currencies as a curiosity, an unknown and misunderstood novelty of the fintech market, which in time became fashionable. In the Silicon Valley or Swiss Zug, paying for Bitcoin was simply cool. But when in 2017 the price of Bitcoin increased from $ 750 to 18 thousand. dollars, everyone wanted to jump to the speeding wagon of sky -high profits.

As is usually the case – Most of them jumped at the very end of the driveway and thus provided only strength to the downhill down. It was then in the world that a discussion on the security of the crypto market began ..

At the beginning, however, a bit about the valuation

The largest analysts of the financial, IT and even sociologists are heading over the BTC valuation. Because while in the case of traditional currencies – by Blockchain fans called FIAT – Their valuation depends on the economy of a given country (plus any reserves in gold), in the case of virtual currencies their valuation is determined by the sentiment of investors. Although here suits the statement of users and access to technology, with emphasis on the last one.

According to the latest We Are Social report, the population of our planet is 7.676 billion people, of which 5.112 billion are users of mobile devices, and 4.388 billion regularly uses the Internet. There is less than 2.5 billion people access to a bank account. What does it mean in practice? Only and so much that the vast majority of humanity cannot accumulate, even storing capital, not to mention its transfer and investing. And here the fintech market comes to the rescue, which wants to patch this hole. Among other things, here you should see the reasons for the increase in cryptocurrencies, but also Revolut applications.

According to the original assumptions of the creator of Bitcoin Satoshi Nakamoto or a group of creators (it has not been established to this day who exactly it was) The availability of this currency has been limited to 21 million units from the very beginning. This is a fundamental difference between Bitcoin and traditional currencies. This means that Bitcoin cannot be artificially printed or regulated by its circulation and availability with interest rates. Users decide about it themselves and so far in this respect they are very resistant to all forms of pressure and control. Acquiring bitcoins is done by performing mathematical processes called „ digging ”, which ensure the proper functioning of the crypt of the currency network, primarily by confirming the correctness of the transaction. Currently, over 17 million bitcoins have been dug up, which accounts for over 80% of all that have ever existed.

Some network users treat virtual currencies as a tool for storing values. The vast majority use this market for efficient capital transfer. Due to the high volatility, investors and speculators are only a fragment of this market. This situation may change when investment banks decide to enter the cryptocurrency market full. However, so far their commitment is very cautious because of the investment risk policy and legal problems.

However, the blockchain technology itself, which is extremely useful for financial institutions – is used by M.in. for authenticating transactions, encryption.

Bitcoin worth as much as plastic?

It can be accepted, as Warren Buffet claims, the investment icon, that Bitcoin only has a load -bearing force of value, like a bowl of a check or a credit card. The cryptocurrency itself does not have much value. Only what he “transfers” has the value. And here we come to a very important conclusion regarding its valuation, namely that its price for the network user does not matter.

In a model where most users use this tool for capital transfer, they buy a virtual currency at the time of transaction, and the beneficiary converts the virtual currency to the Fiat currency at the time of its receipt. From the point of view of the parties to this transaction, it is irrelevant whether they sent a faction or the whole bitcoin at the time of the transfer. From their point of view, it is important that the network works efficiently, safely, the commissions were low and variability at an acceptable level.

What conclusion of this? Theoretically, in the long run with limited supply, the value of bitcoin should increase constantly. Of course, there are a lot of obstacles and turns along the way (legislation, eCT network performance.), but above all there must be faith that a given cryptocurrency is a carrier of values.

Security

Well, now let’s go back to the security topic. The security of the Bitcoin network is based on several pillars, of which the most important of which is a huge and unpredictable combination of a portfolio with the appropriate private key by today’s computers. In other words, we keep the units we have accumulated in a given wallet but only knowing the appropriate key, we have the option of being transferred to another address. The amount of Bitcoin (RipemD-160)-related addresses is 2^160 or 1.462 × 10^48, which is more vividly This is a number comparable to the number of atoms that consist of Earth.

Find lost bitcoins

There are a lot of lost units on the Bitcoin network (so -called. Zombie coins), mainly in the early stage of network development, i.e. in the first year, before the regulation of digging difficulties was introduced. The first price of Bitcoin determined in October 2009 was $ 0.11 and was based on the current value necessary to dig one unit. In addition, a large proportion of users received bitcoins as part of promotional campaigns and attempts to popularize the network.

Until the launch of the first Bitcoin exchange in February 2010, no one paid attention to the security of digging, because bitcoins were practically worthless. Most users treated this project as a kind of curiosity. They kicked out of pure curiosity, and later either they forgot about this fact or gave up disappointed. The units they dug, often landed on the trash with old disks, system replacement, or a regular Disk Cormat: (yes … in those days the disks were formed). It is also unknown what happened to the Bitcoins belonging to the creator of the Satoshi Nakamoto system and to the next pioneer of the Bitcoin Halla Finney network, who died in 2014.

This is when an attempt was made to estimate all Coins zombies. It was estimated that 30% of all Bitcoins dug at the time, were irretrievably lost. Mainly through the carelessness of users or by their deliberate “smoking”, i.e. sending them to random addresses to which there are no keys. The most famous example of such action is the sending of 2124 Bitcoins on the sample addresses by the creators of the XCP currency, who thus wanted to give the value of their own currency. Such actions are called proof-of-kurn.

Users remembered about lost or burned bitcoins in 2017, when the price soared to 18 thousand. dollars per unit, and a publication of an anonymous user appeared on the web. He described his experience in creating private keys consisting of popular phrases and a series of words. He noticed that people have long created keys based on easy to remember numbers.

Bitcoin Totolotek or educational application

What does it mean? Recently, browsing the APP Store after changing the digging policy, I came across the BTC Harvester application. According to the owner’s description. Well, application users have the option of browsing private keys and connect them to the public addresses of the blockchain network. Interestingly, these data is publicly available and if the user finds the key that fits the lock, he sees the history of the transactions concluded.

However, the most interesting is that this is a simple way to search the network in terms of lost bitcoins. The creators of the application say that the likelihood of finding a couple, where the Coins zombie will be stored, is several hundred times less than hitting the six in Totolotka, but unlike Totolotka, the trying does not cost anything ..

Good luck and I hope that by the way I was able to explain a bit to you what the phenomenon of bitcoin is. In the next article I will write a little more about how blockchain works and how to use it.